February 2, 2026

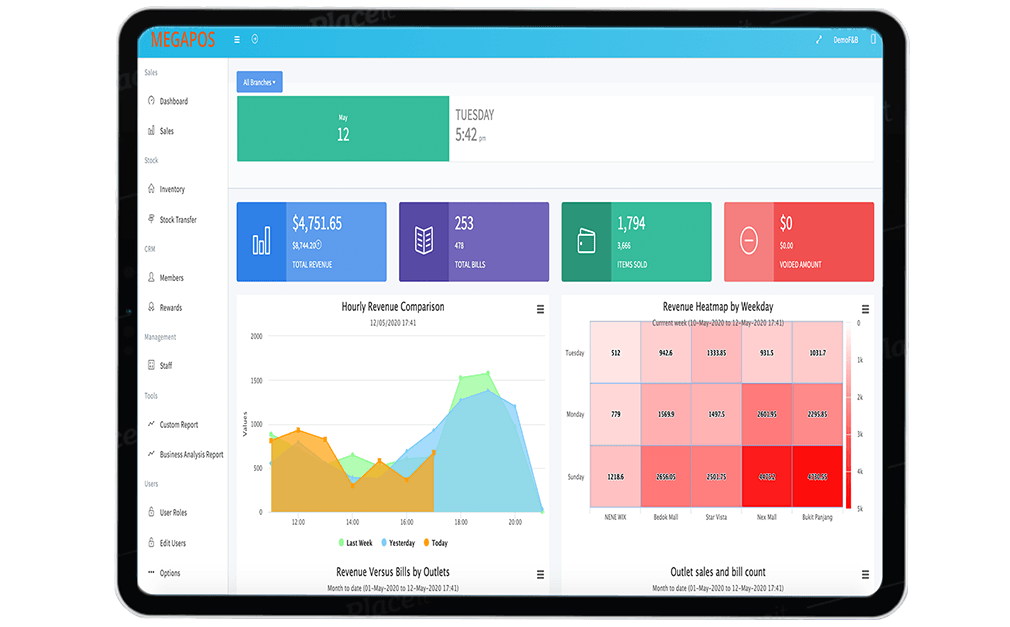

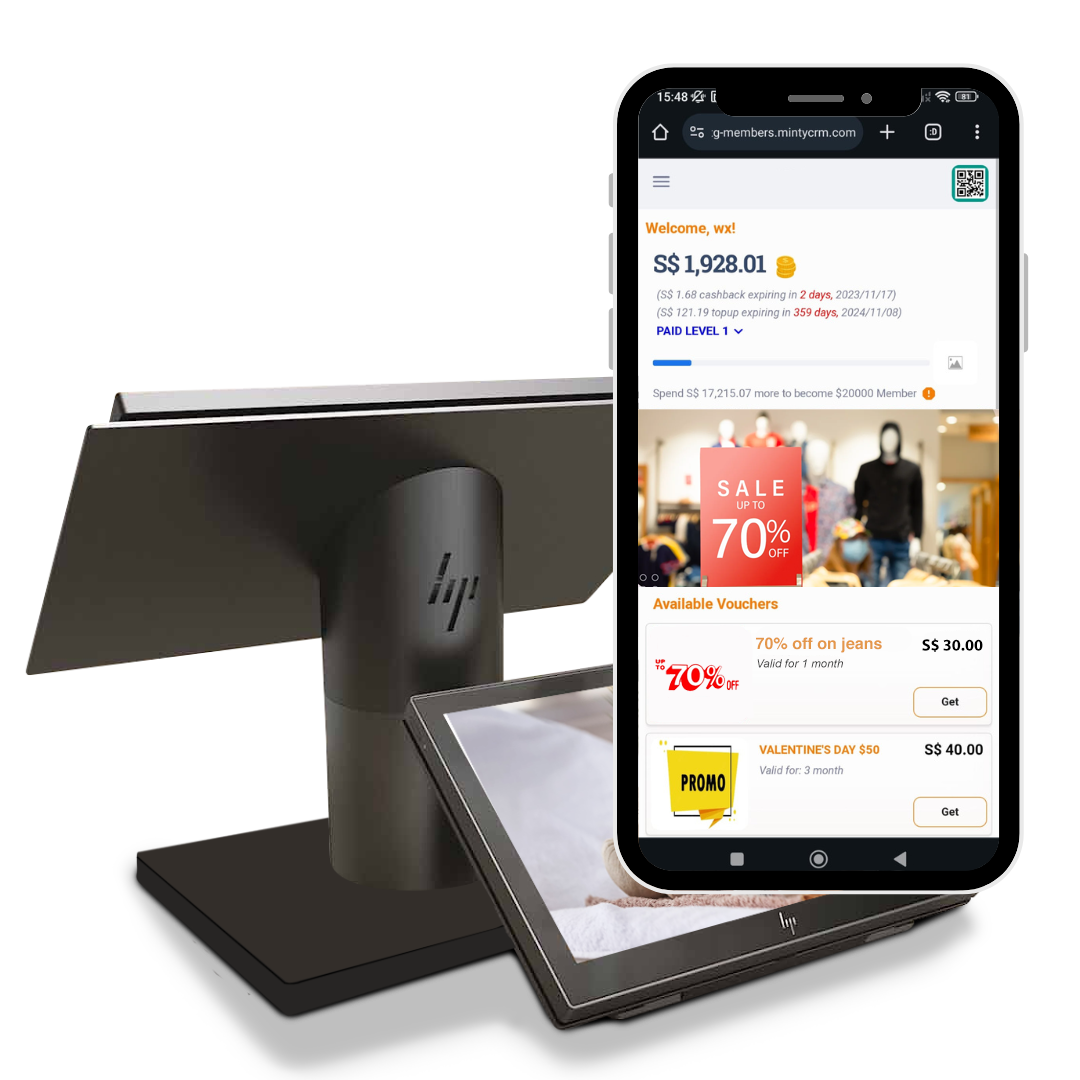

In 2026, food delivery remains a major revenue channel for restaurants in Singapore. Platforms like GrabFood and Foodpanda have become deeply embedded in consumer habits, and many F&B businesses depend on them for daily sales volume. But with rising manpower costs, rental pressures, and tighter profit margins, a crucial question is emerging: Is relying heavily on delivery platforms still sustainable for Singapore F&B businesses? The answer is more complex than it seems. The Rise of Delivery Platforms in Singapore Food delivery platforms saw explosive growth during the pandemic, when dine-in traffic collapsed and restaurants had to pivot quickly. Even after restrictions were lifted, consumer behaviour did not fully revert. Singapore diners became accustomed to browsing menus online, comparing prices instantly, and enjoying meals delivered to their homes or offices. For many restaurants and cafés, delivery now contributes between 20% and 50% of total revenue. From a top-line perspective, this appears positive. More channels mean more visibility and more orders. However, revenue growth does not always equal sustainable profit. The Hidden Cost of Delivery Commissions One of the biggest challenges facing F&B operators in Singapore is platform commission fees, which typically range from 20% to 35% per order. When food cost already consumes 30% to 35% of revenue, and rental plus manpower account for another large portion, the remaining margin can become razor thin. If an average order is $25 and the commission is 25%, that’s $6.25 deducted immediately. Multiply that across hundreds or thousands of orders per month, and the numbers become significant. Over time, these fees can easily amount to tens of thousands of dollars annually effectively becoming a recurring operational tax. The uncomfortable reality is that some businesses are increasing revenue while simultaneously compressing profit margins. Discount Culture and the Race to the Bottom Another sustainability concern is the heavy reliance on platform promotions. Delivery apps frequently encourage flash deals, 20–30% discounts, and voucher stacking. While these campaigns drive traffic in the short term, they also condition customers to order only when discounts are available. Over time, this shifts customer loyalty away from the restaurant and toward whichever outlet offers the biggest discount that day. Instead of building brand preference, businesses become part of a price comparison ecosystem. In such an environment, differentiation becomes difficult, and profitability becomes fragile. The Ownership Problem: Who Really Owns Your Customers? Perhaps the most overlooked issue is customer ownership. When orders are placed through delivery platforms, the platform controls the customer relationship. Restaurants receive the transaction but do not fully own the customer data or communication channel. This means restaurants often have to pay commission repeatedly to reacquire the same customer. Without direct engagement tools such as membership programmes or CRM systems, long-term retention becomes dependent on platform algorithms rather than brand loyalty. In a competitive Singapore F&B market, that lack of control can be risky. A Smarter Strategy: Use Platforms for Acquisition, Build Your Own Channel for Retention The most forward-thinking F&B businesses in Singapore are not abandoning delivery platforms. Instead, they are repositioning them as customer acquisition tools rather than primary revenue engines. Delivery platforms help attract first-time customers. Once customers discover the brand, restaurants can encourage direct ordering through QR ordering systems, branded online stores, or self-pickup channels. By shifting even 20–30% of orders to direct channels, businesses can significantly improve margins. When paired with integrated POS and membership systems, direct ordering allows restaurants to track purchase behaviour, offer targeted promotions, and encourage repeat visits without paying high commission fees each time. This hybrid model reduces risk and increases long-term sustainability. Why Direct Ordering and Integrated Systems Matter Technology plays a key role in this transition. Modern F&B systems that integrate POS, QR ordering, online ordering, and membership solutions allow restaurants to centralise data and operate more efficiently. Instead of relying entirely on third-party ecosystems, businesses can build their own digital infrastructure. This provides greater control over pricing, promotions, and customer engagement, while still benefiting from platform visibility. In a cost-sensitive market like Singapore, control over margins and data is becoming a competitive advantage. The Bigger Question: Control vs Convenience Delivery platforms offer convenience, speed of setup, and built-in traffic. But convenience often comes at a cost. The question for F&B operators is not whether delivery should be used, but how much dependence is too much. Sustainability is no longer just about increasing order volume. It is about protecting profit margins, reducing external dependency, and strengthening customer retention. Restaurants that diversify their sales channels and invest in owned customer relationships are better positioned to navigate rising costs and shifting market conditions. Conclusion: Sustainable Growth Requires Balance Relying solely on delivery platforms may not be sustainable in the long term for Singapore F&B businesses. Commission fees, discount dependency, and lack of customer ownership create structural limitations that can weaken profitability over time. However, delivery platforms remain valuable when used strategically. The most resilient F&B brands combine platform exposure with direct ordering systems and loyalty programmes, allowing them to control margins while continuing to grow revenue. In today’s competitive landscape, sustainable F&B success depends not just on how much you sell but how much you keep. Interested to know more about online ordering solutions that can help you grow your memberbase, engage them, and boost repeat spends? Click here !

Button

Button Button

Button Button

Button Button

Button